Looking for straightforward ways to save some cash while living your best life in Japan? Here are three simple tips that’ll get some extra money in your pocket pronto!

Saving money can be difficult, especially during big life transitions like moving and starting up a new job. Even without altering life transitions, the current state of the economy and the weakening yen hasn’t made saving easy for anyone these days.

Although the current situation with COVID has continued to make it more enticing to stay home and pinch those pennies, Tokyo is starting to open up once again. Meaning that travel and social outings might start crowding your calendar – making it more and more difficult to hold on to that hard earned cash!

If saving is your main goal but you’re having some setbacks on where to begin or how to restart, I’ve got you covered!

Below I’ve compiled a simple guide on three easy ways to save while working and living in Japan. I’ve used all of these tips myself and have successfully been able to pay off all my student loans, send money back home, and even save a little extra for those treat-your-self purchases.

Saving Tip 1: Get a 500 Yen Coin Jar

I’m sure you’ve seen the many colorful 500 yen jars at your local “hyakkin” (100 yen shop), consider grabbing one for yourself from Daiso or Loft. And if you don’t want to spend on a coin jar, you can make your own out of literally anything! You may find that the jars from Daiso or other shops are useful for keeping you accountable because they have specific savings goals written on them and you typically can’t open them unless you smash it to pieces…

The 500 yen coin is magical in the fact that the coin itself is worth quite a lot and when you start saving them, you might start to notice that you can save much more in the long run.

When I get a 500 yen coin back with my change I’ll usually stick it in a separate zip pocket in my wallet or backpack rather than my coin purse. This way, I won’t be inclined to spend it later on in the day as it’s separate.

When I get home I will immediately put the 500 yen coin through the saving jar’s coin slot. The clanging sound of adding a coin to the jar is almost as satisfying as when the jar fills up!

I’ve used this method to save for various items on my wishlist as well as vacations. Saving 500 yen coins takes a little bit longer than just taking a chunk of your paycheck each month but I’ve found this method makes it easy to save without all that added pressure. Just save your coins and add them to your jar when you get home. It’s that easy.

My current jar is set for a dreamy vacation in Okinawa. What will your 500 yen savings goal be?

Saving Tip 2: Skip the Conbini for Food and Drinks

I know, the “conbini” or convenience store is one of the best aspects of living in Japan. The amount of things you can get done at your neighborhood 7/11 is jaw dropping! The list varies from paying your monthly gas and electric bill, printing and making copies of important documents, buying tickets to concerts, sending packages, charging your very dead phone to even now making a smoothie.

Yes, convenience stores are really the best but if saving money is a priority, you may want to hold off buying drinks and food even if it is…convenient..

Convenience stores like 7/11, Family Mart, Lawson, and Mini Stop tend to hike prices of drinks and snacks 10 to 30 yen above what they’d normally cost. Although this doesn’t seem to be a big deal at the moment, if you’re buying from convenience stores for all your meals, the price differences will add up exponentially.

On top of that, you may find yourself adding random things into your cart without thinking! I can’t even remember how many times I’ve walked into a Family Mart for a Mercari envelope and then found my basket filled with random seasonal drinks, makeup, magazines, and tiny collectible toys.

Instead, opt to buy your drinks and snacks at supermarkets or drug stores. You can find most of your favorite items for far cheaper than what you’d find in your neighborhood conbini. If you’re looking to save on fresh fruit and vegetables, find your local vegetable stand. You’ll discover fruit and vegetables marked at far lower prices and often in bigger servings than those even in grocery stores!

Saving Tip 3: Start Using Kakeibo

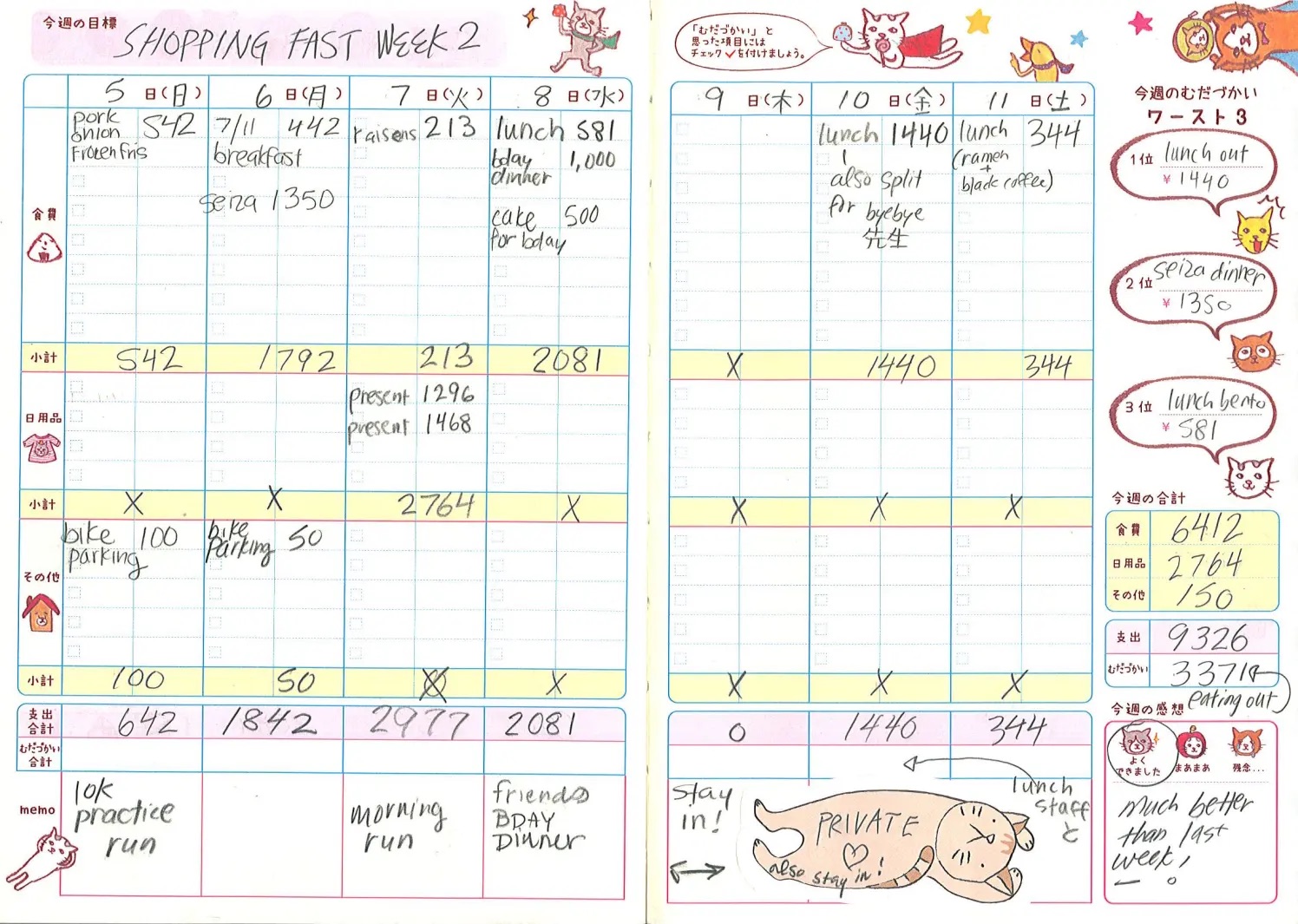

If you’ve toured a stationary store like Loft or Tokyu Hands, you may have thumbed through household ledger books or “kakeibo” 家計簿. The kakeibo is essentially a physical spending tracker in the shape of a diary and is a great resource for those looking to be more mindful in their spending.

Kakeibo are all over the place, you just need to look for them! I personally recommend picking one up at Loft since they carry a wide variety of designs and sizes! I usually use two kakeibo at a time, one pocket sized version to carry around with me during the day, and a larger one that I keep at home to re-record daily spending and bigger expenditures like rent and utilities.

Using a kakeibo is simple, while some are completely empty and leave organization and recording up to the owner, others come with categories already set which makes things easier if you aren’t exactly sure where to start!

Once you start recording, you’ll be able to tally how much you spend at the end of the day, week, and month! Make sure that you’re keeping your receipts so that you can keep track of all your purchases. I try to put all of my receipts in a separate file to keep them organized, but on days where I can’t be bothered, most of my receipts can be found at the very bottom of my bag in various crumpled balls. Whatever works right?

The reason why kakeibo are so popular is because the act of writing down your daily expenses forces you to think about every single individual purchase, even if you don’t want to. I’ve used various kakeibo over the years but my favorite has always been the larger diary versions. When I did a shopping fast a few years ago I used my kakeibo to keep myself accountable and to also track where I needed some improvements. I managed to fix my frivolous spending and was able to set more tangible savings goals in the process.

Saving doesn’t always mean putting large sums of money away every chance you get. Most times it’s about the tiny changes you make in your day-to-day life that really make a difference.

I know that if you start implementing these three tips into your daily routine you’ll not only become more mindful in your shopping but also have the tools to start saving towards your next goal!